Rencent Capital pursues long-term structural value investment and looks for industry pioneers with long-term competitiveness. Through the thorough understanding of China's macro and micro economic trends and comprehensive analysis of the global market situation, Rencent Capital focuses on leading enterprises with unique competitive advantage in fields such as medical health, scientific and technological innovation and consumption, providing financial support at all stages from start-up to post-IPO. The investment category includes fund investment and direct equity investment.

Rencent Capital builds a diversified growth portfolio based on global macro risk hedging, reaches deep cooperation with internationally renowned investment banks such as Morgan Stanley, Goldman Sachs, UBS and participates in the overseas markets, Rencent Capital is the strategic partner of well-known institutions including Sequoia Capital, Hillhouse Capital, Firstred Capital, CICC Capital and CDH Venture Capital.

Rencent Capital has invested in many high potential companies with distinct technology and innovative business model, also with high growth and return potential. The portfolio includes ByteDance, CALB, BYD semiconductor, E-Town Semiconductor, Smarter micro,Clounix, Cloudwis,pingCAP, xingshengyouxuan,JDL, YMM, Huolala,zhuanzhuan,i-mabbiopharma ,BioNova Pharmaceuticals, Haihe Biopharma, ClinChoice and other outstanding enterprises.

Focus on the essence of business, be part of the value creator and refuse opportunism of value reassignment.

Building core competencies based on long-term vision and strategic patience, having the courage to sacrifice short-term interests facing short-term difficulties and temptations, continuing to evolve and grow upwards.

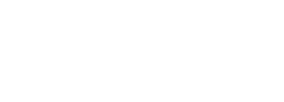

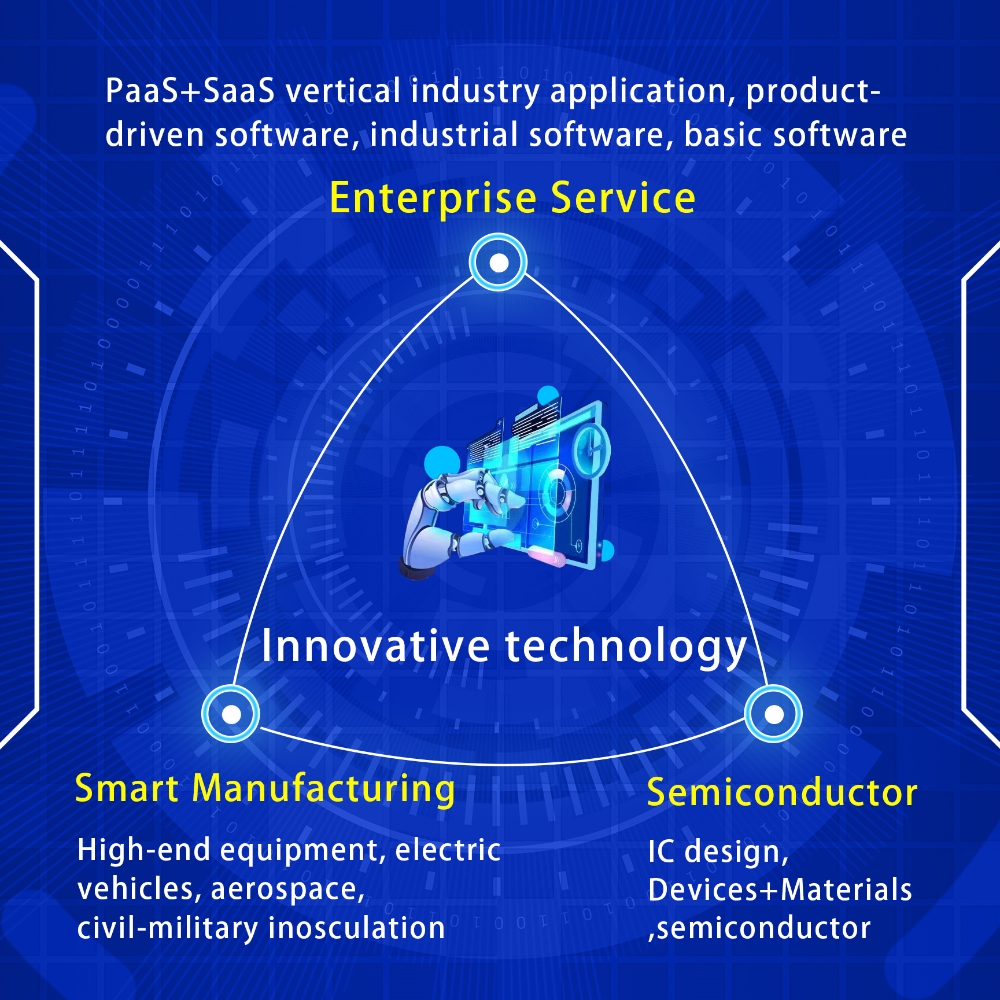

Rencent Capital never follows the crowd blindly, but emphasizes on fundamental analysis, looks for outstanding entrepreneurs around the world, Focusing on the innovative products and services in the new technology, new medical care and new consumer fields brought about by technological progress and concept changebased on the industrial resources and experience in China, providing financial support for enterprises from the initial stage to the post-listing stage.